THE PEOPLE'S BANK

Our Money. Our Values. Our Bank.

LEARN MORE ABOUT THE LA PUBLIC BANK

PUBLIC BANKING RESOURCES

INTRODUCTION

WHAT'S A PUBLIC BANK

The Municipal Bank of Los Angeles (MBLA) will be a nonprofit city-owned bank created to serve the needs of local communities.

OUR PRIORITIES

A FINANCIAL SYSTEM THAT WORKS FOR ALL

Focused on fiscal responsibility, local control, and reinvesting public funds into Los Angeles through housing, jobs, and community development.

HOW IT WORKS

TRANSFORMING LOCAL FINANCE

Authorized by the California Public Banking Act (AB 857), the LA public bank will finance affordable housing, clean energy, and economic justice.

ENDORSEMENTS

WIDESPREAD SUPPORT

Backed by over 100 organizations across California, including credit unions, housing groups, sustainability leaders, and racial justice advocates.

Jain Family Institute and Berggruen Institute

LA MUNICIPAL PUBLIC BANK SERIES

PUBLIC BANK LOS ANGELES

Reshaping finance to build a stronger Los Angeles grounded in community power and shared prosperity.

EXPANDS AFFORDABLE HOUSING OPTIONS

The LA Public Bank could help build over 16,000 homes within its first decade while returning profits to LA taxpayers.

ACCELERATES THE LA GREEN NEW DEAL

The bank can expand renewable energy, cut costs, support LADWP, and fund major sustainability projects.

SUPPORTS WORKERS & SMALL BUSINESSES

It will back worker ownership, expand access to capital, and increase wages, job stability, and local wealth.

LA CITY COUNCIL SUPPORT

WHY LOS ANGELES SHOULD START A PUBLIC BANK

Public banking gives cities the tools to keep taxpayer dollars circulating locally. Each year, Los Angeles pays Wall Street banks more than $340 million in fees and interest and $1.4 billion in debt services. Over $2 billion in city funds are parked in megabanks and petrochemical companies, fueling private profits while LA faces a housing crisis, aging infrastructure, and escalating climate threats.

The Los Angeles Public Bank will be a nonprofit, city-owned, tax-exempt bank that manages municipal funds to support local needs. It will finance affordable housing, public infrastructure, and disaster resilience, replacing high-interest loans from private banks with low-cost credit the city controls. Every dollar deposited in a public bank can generate up to ten in lending power, reinvested in projects that benefit Angelenos.

Governed independently and professionally managed, the bank will operate with full regulatory oversight while aligning public funds with equity, transparency, and sustainability, not Wall Street profits. This is long-term financial infrastructure for a more just and resilient Los Angeles.

ECONOMIC JUSTICE

Invests in underserved neighborhoods to close gaps and strengthen communities.

COMMUNITY ACCOUNTABILITY

Uses transparent strategies to support local development and public good.

SUSTAINABLE GROWTH

Keeps money local to fund housing, businesses, and infrastructure.

FISCAL RESPONSIBILITY

Cuts banking costs and frees up funds for vital city services.

In July 2025, six Los Angeles City Councilmembers—Hernandez (CD1), Blumenfield (CD3), Raman (CD4), Price (CD9), Soto-Martinez (CD13), and Jurado (CD14)—moved discretionary funds into an earmarked account to kickstart the city’s public bank plan. This was built on the Council’s unanimous approvals in May 2024 and June 2023 to fund a Request for Proposal (RFP) to hire consultants for the public bank’s feasibility study and business plan. Once complete, the plan will outline how Los Angeles can establish a city-owned bank through a state charter.

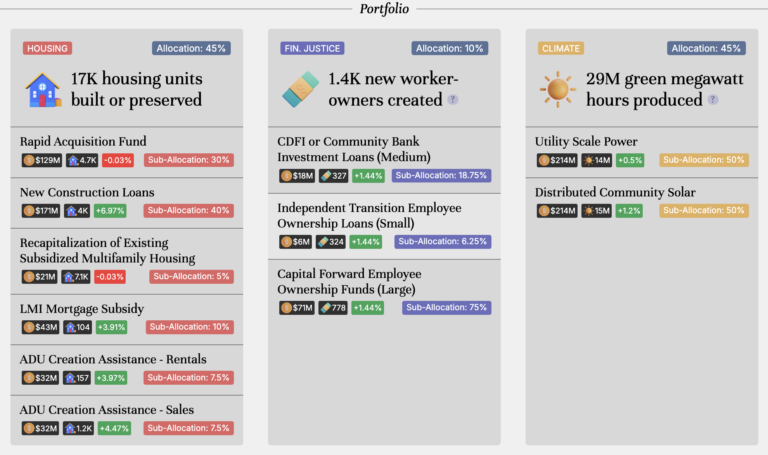

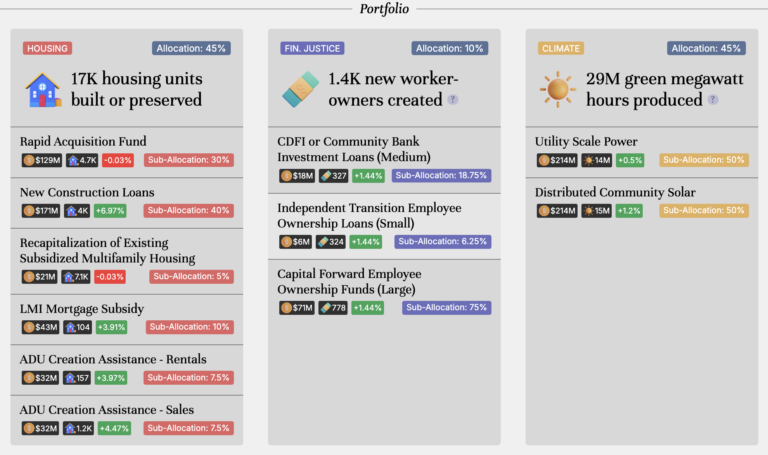

The Jain Family Institute and Berggruen Institute developed a five-part report series outlining how a public bank could use city funds to support affordable housing, green energy, small businesses, good governance, and financial justice. The JFI and Berggruen Los Angeles reports can be found here.

Following the Measure B 2018 vote, where over 430,000 Angelenos supported a public bank, Public Bank LA was a founding member of the California Public Banking Alliance, which led the passage of the Public Banking Act. Signed into law in 2019, AB 857 authorizes California cities to create public banks accountable to residents, not Wall Street.

Public Bank LA also helped pass the California Public Banking Option Act, which started the path for the CalAccount program to provide free, accessible banking services to millions of unbanked and underbanked Californians. In July 2025, the State Legislature approved funding for Phase 1 of the CalAccount rollout.

These steps allow our city to take control of their own money, expand access to basic banking, and put public dollars to work for the people. For updates, visit our News section.

VOLUNTEER

Join our volunteer-led team and use your skills to help build a public bank that serves the people, not Wall Street. Be part of the historic effort to create the Public Bank of Los Angeles and shape a financial system that works for all of us.