By: Emily Alpert Reyes and James Rufus Koren. Los Angeles Times.

Los Angeles voters will decide next month whether to nudge along the budding movement to create a public bank owned by the city.

The choice is a seemingly modest one: whether to alter the City Charter to allow L.A. to create a “purely commercial” enterprise.

City Council President Herb Wesson, who first floated the idea of a municipal bank more than a year ago, said the ballot measure is simply a way to gauge whether Angelenos want officials to explore a public bank before the city goes to the trouble of hammering out a detailed plan.

“If people say, ‘We don’t want you to do this,’ then we don’t move forward with it,” Wesson said.

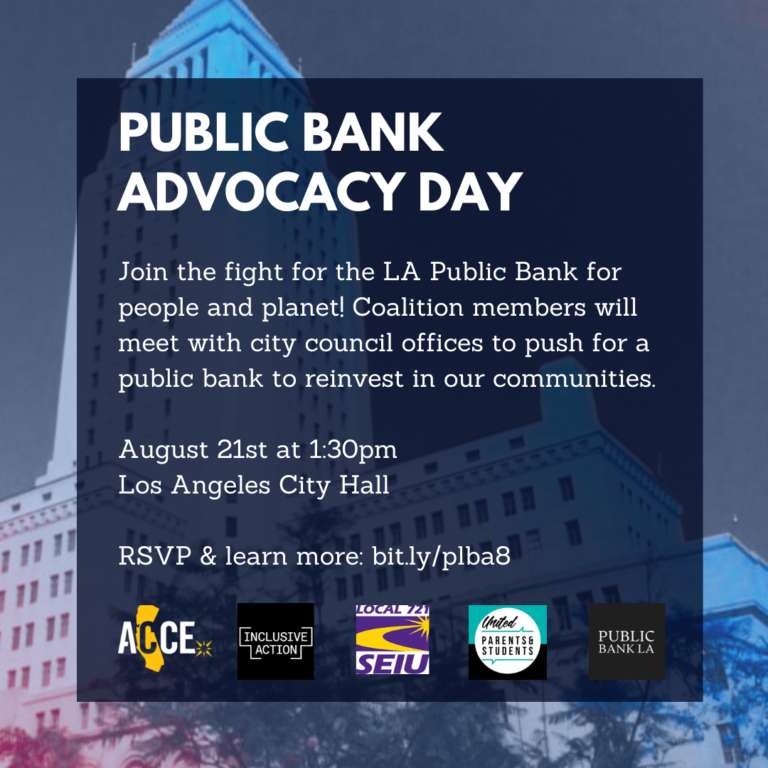

But public banking advocates nonetheless see Charter Amendment B as a potential watershed moment — one that could help shape the debate about public banks for years to come.

If the ballot measure passes, advocates say it would bring fresh momentum to the public banking movement, as Los Angeles could be the first jurisdiction in the U.S. where voters have signed off on the idea.

There are only two public banks in the United States and its territories: the Bank of North Dakota, which was founded nearly a century ago, and the recently formed Territorial Bank of American Samoa, which was created after commercial banks decided to stop doing business in the seven-island territory.

Economic justice groups and other advocacy organizations have backed the idea of financial institutions owned by cities or states as an alternative that could save money on banking fees, avoid risky financial schemes and predatory lending, refinance public debt at lower rates and generate profit that could be invested to help the community.

Backers have pointed to recent scandals at Wells Fargo, which admitted to creating as many as 3.5 million unauthorized accounts, as an example of the ills of the financial services industry.

They have also highlighted the successes of the Bank of North Dakota, arguing that it successfully weathered the last recession without the bailouts that went to Wall Street banks, and has returned tens of millions of dollars in profits to state coffers.

The ballot measure is “the first step in a process where Angelenos will decide what kind of bank they want to put their money in — the Wall Street banks that crashed the economy and invest in guns and oil — or a public institution that invests in Los Angeles,” wrote David Jette, legislative director for Public Bank L.A., a local group advocating for the measure.

Continue reading at LATimes.com.