What an exciting year for LA’s public banking movement. We’re proud of what we’ve accomplished and grateful for the work of our community supporters and partners who kept pushing, even through a challenging year for our city and nation. From the fires to ICE raids and a volatile federal landscape, we’re so moved by your commitment in the face of adversity and proud to have you standing by our side.

Enjoy the latest updates on our recent work and accomplishments. We’ll see you all in the new year!

Support for the public bank is growing at Los Angeles City Hall. Nine LA City Councilmembers have now committed their discretionary dollars to fund the Public Bank feasibility study, ensuring this work continues at full speed. Spectrum News covered this milestone in “Momentum Grows as LA Moves to Create Public Bank.”

Watch the short excerpt from the segment here.

As Councilmember Hugo Soto-Martínez put it: “Our taxpayer dollars are paying for these projects and at the same time, [could be] saving hundreds of millions of dollars that we currently pay in interest to Wall Street banks.”

PBLA’s Executive Director, Trinity Tran, grounds it in the long view: “This bank will start small and will lend conservatively, and it will grow as loans are repaid and interest supports the bank. But that is exactly what the feasibility study will lay out.”

Full segment here.

LA County Endorses the Los Angeles Public Bank

The LA County Democratic Party (LACDP), representing over 3 million registered Democrats, has officially endorsed the LA public bank — the Municipal Bank of Los Angeles. Special thanks to the Culver City Democratic Club for championing the resolution.

In its adopted measure, LACDP supports a nonprofit, city-owned, tax-exempt public bank designed to:

- Manage and deploy the City’s funds

- Partner with mission-aligned local lenders

- Finance affordable housing, green infrastructure, and community resilience

All with one goal: keeping public dollars circulating in our neighborhoods rather than leaving Los Angeles.

A Conversation with Michael A. McCarthy

We are not alone in imagining a financial future where public dollars benefit our communities in much more equitable ways.

Michael A. McCarthy has spent years tracking how finance can be wrestled back under democratic control. He’s the author of The Master’s Tools: How Finance Wrecked Democracy (And a Radical Plan to Rebuild It) and lead author of the Democratic Governance Framework for a Municipal Bank of Los Angeles brief with the Jain Family Institute and Berggruen Institute. His framing in this interview mirrors what we’re building with Public Bank LA which are coalitions of workers and community groups taking real control over how public money is invested in Los Angeles.

“These coalitions of labor and community-based organizations, ordinary working-class people, are trying to set up public banks that are run democratically. If you take a project like Public Bank LA, for instance, its coalition includes the service employee’s union SEIU Local 721 as well as a racial justice organization called ACCE Action.”

These fights are never won alone. Public Bank LA is powered by a cross-section of LA people-power including groups like Inclusive Action for the City, Move LA, DSA-LA, United Parents and Students, and Destination Crenshaw, and over 100 supportings orgs organizing to bring public money back under public control in Los Angeles.

Coverage in Crain’s Chicago Business

Los Angeles is covered in the Dec. 9, 2025 article in Crain’s Chicago Business, “Public banks are an old idea gaining new currency.” “California is on the leading edge” of this fight, and Public Bank LA and CPBA’s Executive Director Trinity Tran puts the stakes plainly: “We’ve got a litany of funding streams that are going to be impacted by the volatility of the federal government,” which is why public banking feels urgent right now. And the North Star is scale: “The power of a public bank is that you can maximize the impact of public dollars at scale.” For CA, that’s the promise of building on the California Public Banking Act and turning public money into long-term community capacity.

Read the article: https://www.chicagobusiness.com/elevate/federal-funding-cuts-stir-interest-public-banks

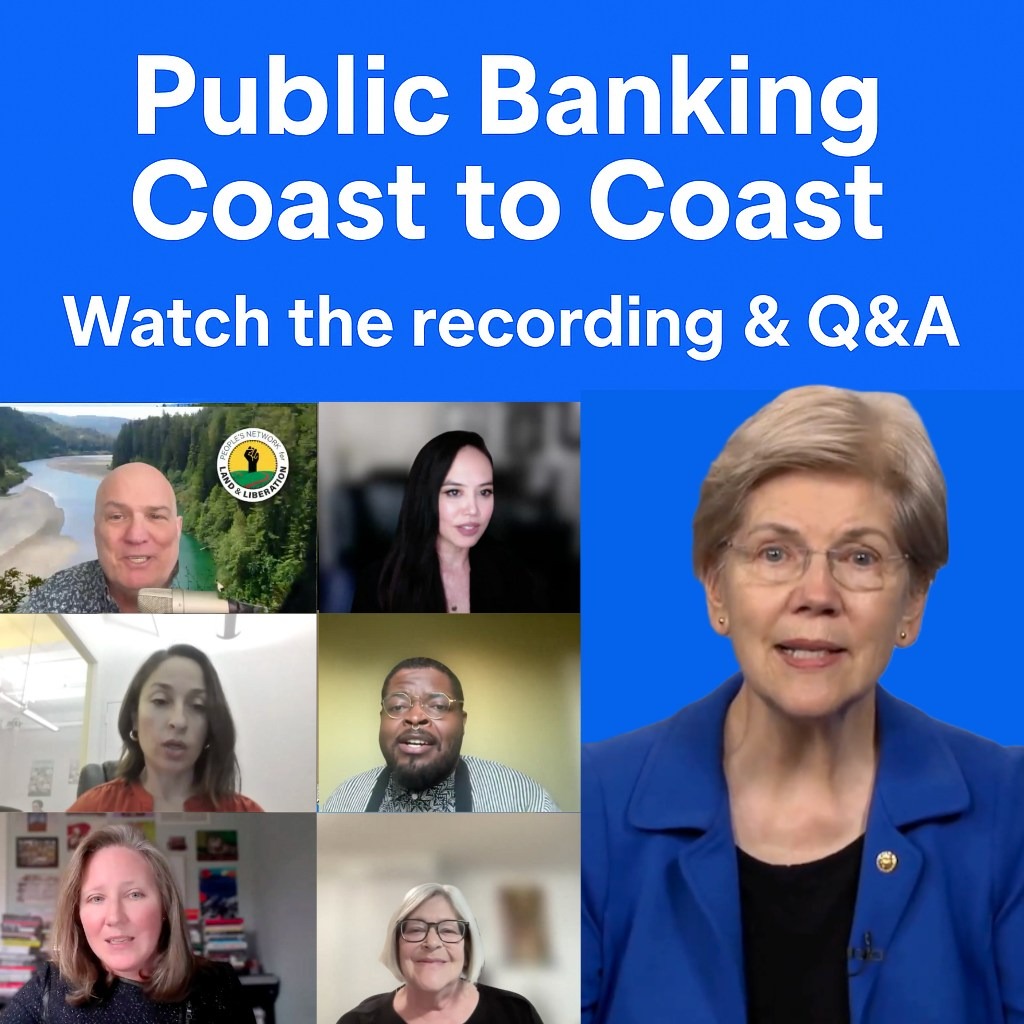

Public Banking Coast to Coast Webinar: A National Conversation with Senator Warren

The Public Banking Coast to Coast webinar brought together a powerful coalition with the California Public Banking Alliance, New Economy Project, University of Michigan, The Democracy Collaborative, and Massachusetts Public Banking, including opening remarks from Senator Elizabeth Warren.

Participants from 39 states and several countries joined a conversation on how public banks can:

- Lower costs for cities and taxpayers

- Keep capital local

- Invest in housing, small businesses, and climate resilience

- Build long-term community wealth

Senator Warren underscored a core truth for this moment: public money should serve the public. Public Bank LA’s Trinity Tran helped lead the discussion, shaping the national narrative on implementation.

We received more than 130 Q&A questions focused on how to move public banking from idea to implementation. Materials below:

- Webinar recording: See the full session here and Senator Warren’s message here.

- Audience Q&A: Link

- Resources from the event: Link

More to come from the national public banking movement!

Harvard Law School Summit: The Future of Public Finance

Energy is still high coming out of the Harvard Law School Public Banking Summit, where organizers, practitioners, and policy leaders convened to map the next era of public finance.

Public Bank LA and CPBA Executive Director Trinity Tran spoke on a panel highlighting the organizing and policy breakthroughs happening in Los Angeles and across California.

Don Morgan, CEO of the Bank of North Dakota, offered a resonant reminder of what a century of public banking can achieve, from keeping state dollars circulating locally to strengthening the small-business ecosystem through partnerships with community banks and credit unions.