The second publication highlights how the LA public bank could transform the city’s affordable housing landscape.

Current policies are projected to add only 20% of the city’s self-assessed needs for affordable housing units by 2029. The JFI/Berggruen briefing dives into the challenges of affordable housing and reveals how feasible projects often get overlooked due to the limitations of the existing financial system.

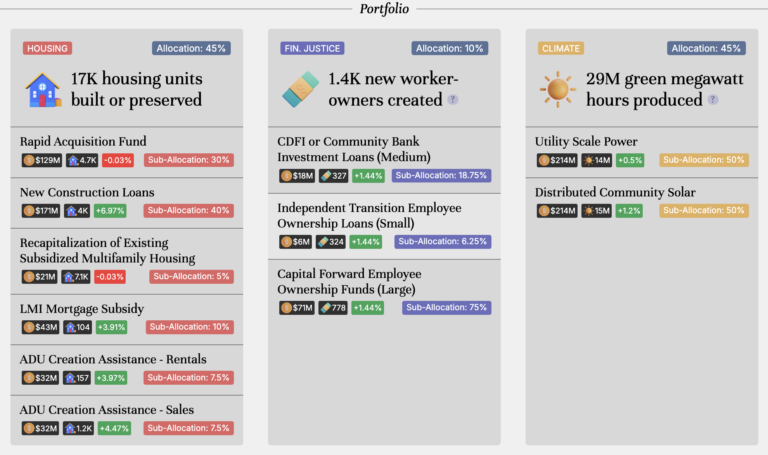

The report presents five groundbreaking LA Public Bank lending programs customized for affordable housing finance, including a rapid acquisition fund, new construction loans, and assistance in creating homeowner accessory dwelling units. These programs could help build or preserve over 17,000 affordable units in Los Angeles during the first decade of operation while making a profit for taxpayers.

This publication is part of the ongoing Municipal Banking Series on the impact of a public bank in Los Angeles. Future releases will explore how a public bank could democratize financial institutions, accelerate the green energy transition, and empower worker ownership of small businesses. Stay tuned for more exciting updates on how the LA public bank can revolutionize finance and empower communities in need.