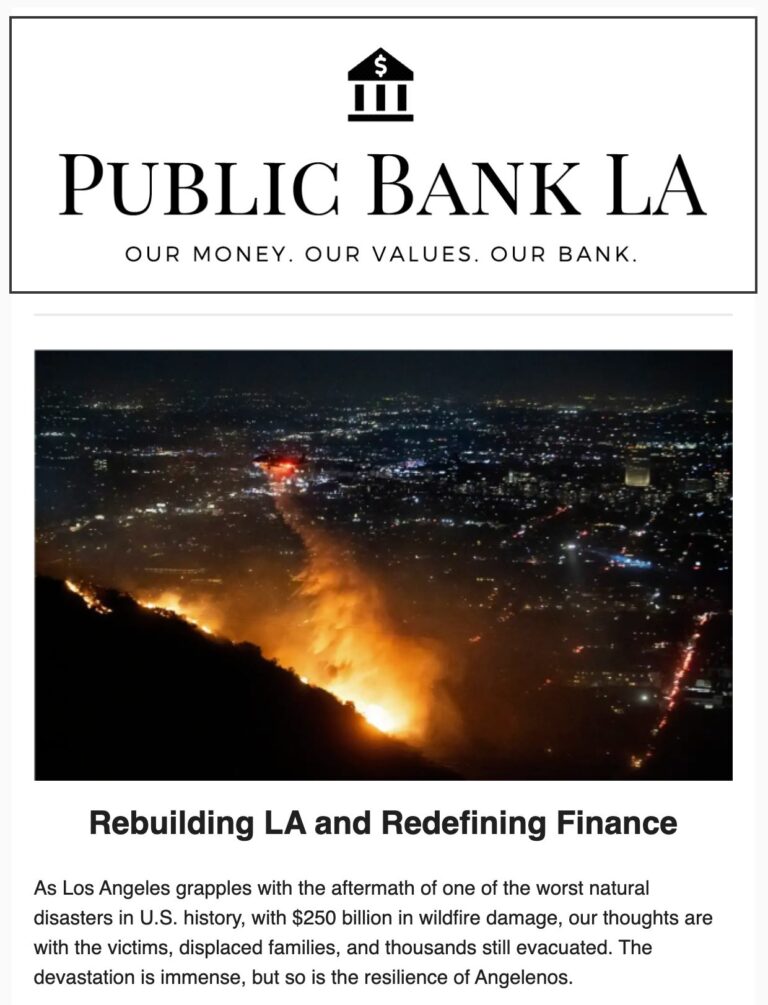

PROGRESS REPORT

LA is one step closer to creating a public bank as the council voted to allocate $460,000 to a feasibility study — thanks in part to a landmark report which brought the possibilities of municipal banking to life. After a local ballot measure failed in 2018 that would have allowed the city to explore the concept, a new state law passed in 2019 cleared the way for California cities to form municipal banks without changing their charters. Working with longtime Public Bank Los Angeles organizers, researchers from the Jain Family Institute and the Berggruen Institute assembled a five-part report that envisions a hypothetical Municipal Bank of Los Angeles structured around three focus areas: financing affordable housing production, providing loans for worker-owned small businesses, and funding renewable energy like community solar projects. The report even includes a nifty balance sheet simulator, and using these real-world examples to highlight the benefits of municipally financing the city’s existing goals particularly resonated with councilmembers.

The interactive balance sheet simulator allows anyone to tinker with proposed LA public bank investments.

“It’s burdensome and expensive to get loans from private banks to build out critical projects in our city like affordable housing, infrastructure improvements, and solutions to climate change,” said Councilmember Hugo Soto-Martinez in an explainer sent to CD 13 constituents. “But with a public bank, these projects would not only be cheaper and more efficient, but actually grow our public funds!” Some critics who are supportive of the concept overall still hold reservations that maybe the city shouldn’t be creating a public bank until we resolve some of our own local corruption — these are valid concerns — but if you think LA’s corrupt, wait until you hear about big banks!