Read our July 2025 Newsletter.

Six LA Councilmembers Back Public Bank Plan with Their Own Funds

The public bank plan is gaining momentum as six City Councilmembers step up by contributing discretionary funds from their own offices. Councilmembers Bob Blumenfield (CD 3) and Curren Price (CD 9) will officially join Councilmembers Eunisses Hernandez (CD 1), Hugo Soto-Martinez (CD 13), and Ysabel Jurado (CD 14), with Councilmember Nithya Raman (CD 4) also adding her support. It’s time for the rest of the City Council to step up and follow their lead so we can build a city that invests in us.

Now backed by these six offices, the plan will explore how LA can stop relying on Wall Street and start using its own funds to lower borrowing costs, cut fees, and invest directly in community needs like affordable housing, local businesses, and infrastructure. With LA spending over $1.4 billion a year on debt, we need real solutions to fund our city’s future.

ACCE Los Angeles, SAJE, KIWA, Movement Legal, and Inquilinos Unidos LA showed up at LA City Hall in force to demand action. Community leaders pushed the City Council to fully fund the Public Bank plan, fighting for a future where LA keeps its money local to support LA’s working families.

Coalition members are calling on Budget & Finance Chair Katy Yaroslavsky (CD 5) and Government Operations Chair Imelda Padilla (CD 6) to act now. The City can’t afford to wait. Agendize the motion and fully fund the public bank plan.

Let’s keep up the pressure! Over 1,500 letters sent — send your letter now: https://actionnetwork.org/letters/public-bank-la-final-budget-push

Councilmember Hernandez Talks with LAist

Should Los Angeles establish a public bank?” LAist asked. Councilmember Eunisses Hernandez says yes, and we agree! With deficits growing and federal financial systems prioritizing profit over the public good, LA needs local control over its capital. A public bank lets the City do more with what it has, without raising taxes or cutting services.

Bank lobbyists have spread misleading claims. Los Angeles has never operated a bank. The failed LA Community Development Bank wasn’t a true bank; it was a loan fund that was “private sector-oriented.” It wasn’t chartered, didn’t take deposits, and lacked the structure and oversight of a regulated financial institution.

The LA public bank would be fundamentally different as a state-chartered, professionally managed, and fully regulated public bank, and accountable to the people, not private shareholders! It would be designed for long-term financial sustainability and public benefit, not private profit.

Opponents cite technical differences between the Bank of North Dakota’s (BND) reporting and GAAP (Generally Accepted Accounting Principles) standards, which is a weak excuse to discredit a century-old public institution. There is no financial mismanagement. The BND holds an A+ rating from S&P, making it safer than Wall Street banks. It remains a successful public bank in the U.S., delivering 18% returns last year, with strong capital reserves, low default rates, and strong partnerships with CDFIs, community banks, and credit unions.

At a time when cities are being forced to do more with less, LA deserves a financial engine that actually works for Angelenos and our communities, not Wall Street profits.

Listen to Councilmember Hernandez’s clip from the LAist interview here.

Public Bank LA in Los Angeles Business Journal

From the Los Angeles Business Journal: As LA seriously considers launching its own public bank, Public Bank LA’s Executive Director, Trinity Tran, said, “This seed money is an important step toward creating a public bank for Los Angeles. It gives the city a way to stop outsourcing control of its resources and start using public dollars to solve public problems without raising taxes or cutting essential services. With deficits mounting, we can’t afford business as usual.”

Backed by now six council offices, the public bank plan will explore how the city can stop relying on Wall Street and start using its own funds to lower borrowing costs, cut fees, and invest directly in community needs like housing, local businesses, and infrastructure. With LA spending over $1.4 billion a year on debt, we need real solutions to fund the future of our city.

California State Budget includes $1M for CalAccount!

California is moving forward with CalAccount, a first-in-the-nation, fee-free public banking option for over 7 million unbanked and underbanked residents, including 2.5 million households hit hardest by junk fees and overdraft penalties. Thanks to the leadership of Governor Newsom, Speaker Rivas, Assemblymember Jesse Gabriel, Treasurer Fiona Ma, and Assemblymember Avelino Valencia, CalAccount is finally becoming a reality.

Too many Californians still can’t access something as basic as a bank account. CalAccount offers a safe, no-fee alternative with no minimums and no penalties, just a simple public option to manage your money. And it’s built to sustain itself over time, without taxpayer dollars.

The $1 million investment to kick off Phase 1 of CalAccount implementation is a major win, the result of years of organizing by the CalAccount Community Coalition, led by the California Public Banking Alliance, SEIU California, co-sponsors, and over 200 community allies. We’re getting ready to roll out CalAccount. Add your name and join the movement: Endorse CalAccount here.

Event Wrap-Up With Rep. Rashida Tlaib!

Thanks to everyone who joined The New School’s Public Banking Panel with Congresswoman Rashida Tlaib and Public Bank LA’s Trinity Tran. Watch the recording and hear about how Public Banking and Guaranteed Income can work together to tackle income inequality, provide immediate relief, and build long-term structural change.

Watch the recording: https://vimeo.com/1094198348/1982f4784b

We answered 50+ audience questions. Check them out here!

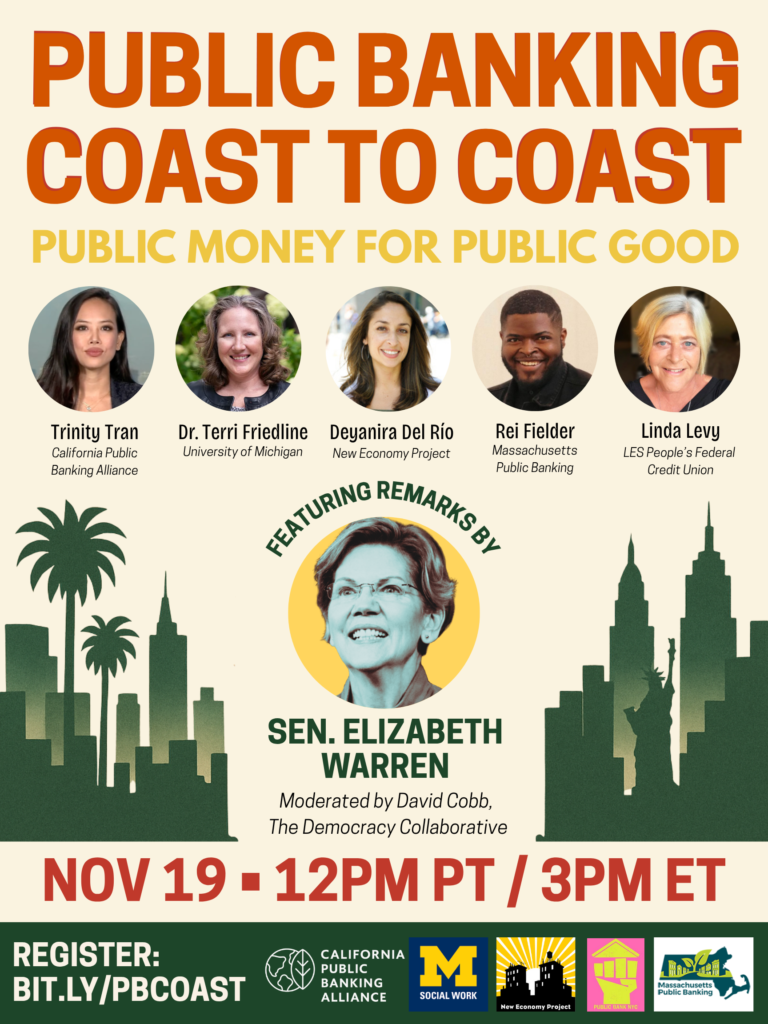

Panelists included public banking and GI leaders: Representative Rashida Tlaib, U.S. Representative, Terri Friedline, University of Michigan, Darrick Hamilton, The New School, Amy Castro, University of Pennsylvania, and moderated by Graham Steele, Stanford Law School.

We’ve released a new brief in collaboration with the University of Michigan: Public Banking in California: Learning from the Bank of North Dakota. It’s the most comprehensive U.S. economic report to date focused on California public banks — and the first academic analysis using the Bank of North Dakota as a case study.

Special thanks to contributors from the University of Michigan, California Public Banking Alliance, Small Business Majority, Demos, and Beneficial State Foundation.

The findings confirm what advocates have long said: BND works. Public banks can save money, expand affordable housing, increase access to capital for small businesses, and help close racial wealth gaps. The goal is to provide a data-driven foundation for California’s public banking movement and inform future policy to establish public banks statewide.

Read the full report: Public Banking in California: Learning from the Bank of North Dakota.