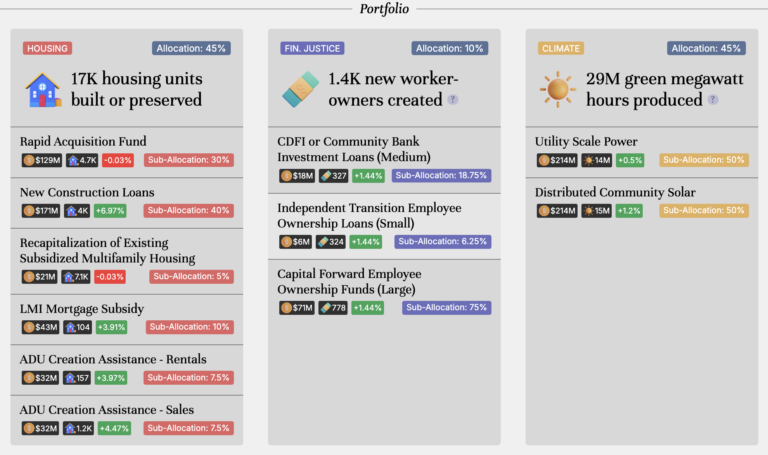

The JFI and Berggruen report series extensively explore how the Los Angeles public bank will make a real difference with targeted investment and lending programs in areas like affordable housing, worker-owned small businesses, and the shift toward green energy.

In June 2023, the Los Angeles City Council approved the resolution to move forward with funding the feasibility study and business plan for a public bank in the city. This decision followed the passing of California’s groundbreaking Public Banking Act (AB 857), which allows municipal governments to establish public banks. The Jain Family Institute and Berggruen Report is a response to this development, offering practical lending and investment options that address advocacy demands in affordable housing, small business lending, green energy, and democratic governance.

The introductory working paper will accompany a series of in-depth reports on various lending programs, set to be released by the end of May. These reports will delve into the opportunities and limitations of a public bank in Los Angeles, considering viable pathways to incorporation and the legal constraints the bank may face. The analysis will also focus on the unique value a public bank can bring to the broader ecosystem of financial institutions with similar goals.

In light of the recent banking crisis and private banking collapses, now is the perfect time to create the essential financial infrastructure our city lacks—one designed to invest in the long-term and benefit the greater good. The Jain Family Institute and Berggruen reports will contribute significantly to the ongoing conversation surrounding public banks and their role in taking on social and environmental challenges in L.A. and beyond.